The Stock Market Crash of 1929

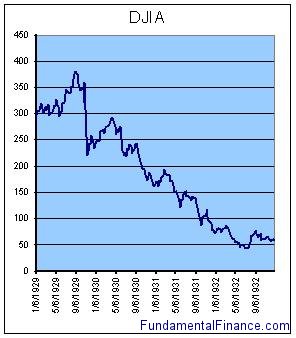

On Tuesday October 29th, 1929, a stock market crash cost the market about 12 percent of its value. Although the loss was staggering, it was only a portion of the loss that was to occur in the following 3 years. In 1932 the DJIA reached a low of just 11% of its high in 1929, or a loss of roughly 89%. It reached a high of 381.17 in early September of 1929 and a low of 41.22 in July of 1932. Although we can recognize some of the conditions that helped to fuel the stock market crash of 1929, what set it off is harder to determine.

The 1920's post WWI era was one of tremendous growth, optimism, and prosperity. Americans had returned victorious and optimistic from the first World War. Industries had been greatly expanded to help support the war effort, and these helped establish capital to fuel the growth in the 1920's. Electricity was also becoming mainstream and beginning to make its way into the daily life of regular citizens. Radio became popular and people began to tune into radio programs on a regular basis. Charles Lindbergh made his famous flight over the Atlantic in 1927. Even the first automatic bread slicer was invented in the late 1920's.

Economic growth during the 1920's was very real--even through 1929. Inflation was low while at the same time real income and production were both rising at over 3% per year. Several companies were increasing their dividend payouts. Leading economists of the day, including John Maynard Keynes, had money invested in the stock market and some even suggested buying after the October 1929 sell-off.

During the 1920's more middle-class and lay citizens began investing in the stock market. Buying on margin became very popular. Margins were generally around 50% at the time--that is, a lay investor could give his broker only 50% of the value of the stocks he wanted to purchase and the broker would put up the rest of the money. The investor would then pay interest on the loan that the broker gave him--the 50% value of the stocks. If the stocks increased in value then the investor got to keep all of the profit. When he sold he would pay off his debt to the broker. If the value of the stocks were to decrease below 50% (or some set level) of the price that they were bought at, there would be a "broker's call" where the investor would have to give more money to the broker or sell the stock and pay off his debt. When someone buys on margin, the stock itself is acting as collateral. If the value of the stock decreases below the margin, then even after selling the stock the investor would still owe the broker money.

Buying on margin probably helped to fuel some of the stock market prosperity during the 1920's. At the time buying on margin wasn't regulated so the brokers could choose the margins they were willing to give. In fact, by the end of October 1929, the average margin had decreased by about 25%--worsening the situation. Buying on margin allows investors to buy more than they otherwise could have. For example, if Henry thought that stock ABC was a good buy and he had $1000 to spend, if he bought on a 50% margin then he could buy $2000 worth of ABC stock instead of just $1000. This has a tendency to push the market up. Imagine one million "Henry's" being able to double the amount of money they were willing to invest in the stock market.

There is not a lot of evidence that most stocks were "overpriced", the average Price Earnings (P/E) ratios of stocks was only around 15 by 1929. Today the S&P 500 is has an average P/E ratio around 21. However, there is some evidence than public utility stocks were overpriced. Public utilities are regulated--that is, the government sets a limit on how much they are allowed to earn. The prices of public utility stocks were high given their government-set return limits. Public utilities can earn excess returns because of weather or regulation lag, but nothing extraordinary. Public utility stock prices seemed to indicate otherwise.

The media seems to have been part of the cause of the October sell-off. In the weeks preceding Black Thursday many articles surfaced asserting that there was too much speculation in the American stock market and that stocks were overpriced. In October front page headlines discussed recent market losses and questioned whether share-holders were beginning to pull out. Evidently this feeling trickled down to make investors nervous. The market lost about 6% from the beginning of September to October 27 (the Sunday before Black Tuesday).

On Thursday, October 24, 1929, the largest volume ever traded on the New York Stock Exchange was recorded--12,894,650 shares--crushing the previous record of 8,246,742 shares set in March. The volume was so high that the market tickers got over an hour behind. The market lost value early in the day but then regained it later on. New York bankers were given credit for stopping the crash as they put about $1 billion into the market. Over the weekend the New York Times reported that Massachusetts regulators weren't going to be as friendly towards public utilities. On Monday 9,212,800 shares were traded. Finally on Tuesday, October 29, 1929, 16,410,030 shares were traded and the market suffered a staggering crash of about 13%. During the week the market would lose 30% of its value.

The nervousness that existed amoung investors caused many people to sell once they saw the high volume and the ticker-lag. It's as if you were in a movie theater and someone screams "Bomb!" Buying on margin also helped to push the market down once the crash began. When stock prices fell, investors were forced to sell their shares so that they could pay back their brokers. This forced prices further down and the cycle continued.

When investors couldn't pay back banks the money they had borrowed, banks began to fail. Banks had also invested money in the stock market, but even a well diversified portfolio couldn't protect anyone from the crash that occurred. For a while banks borrowed money from the Federal Reserve System, but eventually no more funds were available and banks began to break by the hundreds. If people thought that their bank was going to fail they would run to withdraw their money, making matters even worse.

Eventually in 1932 the market bottomed out. By this time the Great Depression was very real and it would take another 23 years before the market would ever fully recovered from stock market crash of 1929.

by B. Taylor, 2006

References:

- The 1929 Stock Market Crash - Harold Bierman, Jr. of Cornell University's article. An excellent in-depth article about the stock market crash of 1929, used as a reference for this article.

|